Cash Flow Hacks: How I Spotted Market Gains Without Gambling

Ever felt like your money’s always one step behind? I’ve been there—watching opportunities slip by while stuck in the paycheck-to-paycheck loop. But after testing strategies that actually work, I discovered how smart cash flow moves can unlock real market advantages. No hype, no wild risks—just practical steps that helped me gain control and spot openings others miss. Let me show you how. It started with a simple realization: wealth isn’t just about how much you earn, but how well you manage the timing and flow of your money. With the right structure, even modest incomes can seize moments that feel out of reach for others.

The Cash Flow Trap Most People Don’t See

Most people think managing money means creating a budget and sticking to it. While budgeting is essential, it only tells part of the story. The deeper issue lies in the alignment—or misalignment—between when money comes in and when it goes out. This imbalance creates what financial experts often call a liquidity gap, a silent drain that affects not just daily comfort but long-term opportunity. Imagine earning a solid income, yet when a promising investment opens up—a limited-time offer, a market dip with strong recovery potential—you can’t act because your funds are tied up in fixed expenses or poorly timed obligations. This is the cash flow trap: having money on paper but lacking access to it when it matters most.

I experienced this firsthand a few years ago. Despite a steady job and what seemed like responsible spending, I missed a chance to invest in a growing sector during a temporary market correction. The window lasted only a few days, and by the time my next paycheck arrived, the opportunity had vanished. At first, I blamed timing or luck. But after reviewing my financial patterns, I realized the real culprit was poor cash flow design. My income arrived once a month, but bills were scattered across different dates, leaving little breathing room. I was managing expenses, not enabling action. This reactive cycle is common, especially among those who equate financial health with income level rather than liquidity control.

The shift began when I stopped asking “How can I earn more?” and started asking “How can I structure what I already have to work better?” This mindset change revealed a critical truth: cash flow is not a passive outcome—it’s a system you can design. By mapping out all inflows and outflows, I identified periods of surplus and scarcity. Then, I adjusted payment dates where possible, staggered large purchases, and built in intentional gaps between paychecks and obligations. These small changes created pockets of available cash, not just for emergencies, but for strategic moves. The result? I was no longer waiting for permission from my paycheck to act. I was in control, and that control became the foundation for spotting and seizing market gains without gambling.

Why Timing Is Everything in Market Opportunities

Markets don’t operate on a monthly payroll schedule. They move in response to economic data, global events, and investor sentiment—often without warning. The most valuable opportunities arise suddenly: a stock correction in a fundamentally strong company, a new sector gaining momentum, or a temporary oversupply in a commodity market. These moments favor those who can act quickly, not those who must wait weeks for their next paycheck. Timing isn’t just an advantage—it’s often the difference between profit and missed potential.

I learned this lesson the hard way during a period of market volatility. A sector I had been monitoring—renewable energy—experienced a sharp but temporary decline due to short-term regulatory concerns. Analysts predicted a rebound within months, but the drop created an immediate buying opportunity. I wanted to act, but my available cash was locked into rent, car payments, and other fixed costs. By the time I could reallocate funds, the prices had already recovered by 15%. That moment stung not because I lost money, but because I had the knowledge and conviction—yet lacked the liquidity to follow through.

This experience reshaped my understanding of financial readiness. Long-term investing is important, but short-term agility is what allows you to enhance those long-term results. The key isn’t chasing every market swing, but being prepared when a high-conviction opportunity aligns with favorable conditions. This requires more than savings—it demands strategic liquidity. I began treating available cash not as idle money, but as a tool waiting to be deployed. By forecasting my cash flow on a weekly basis, I started identifying predictable low-spending periods where funds could be temporarily allocated to opportunity reserves. I also reduced reliance on credit for routine expenses, ensuring that credit lines remained available for true opportunities, not daily overspending.

Over time, this focus on timing transformed my financial rhythm. Instead of reacting to market movements, I began anticipating them. I noticed that certain economic reports were released on predictable schedules, often triggering short-term volatility. By positioning cash in advance, I could act within hours, not weeks. This isn’t speculation—it’s preparation meeting opportunity. And the beauty of it is that it doesn’t require large sums. Even small, well-timed investments can compound into significant gains over time. The real edge isn’t in predicting the market; it’s in being ready when the market offers a gift.

Building Liquidity Buffers Without Sacrificing Growth

One of the biggest misconceptions in personal finance is that holding cash is a waste of potential returns. Many believe that every dollar not invested in stocks, real estate, or other assets is losing value. While it’s true that inflation erodes purchasing power over time, the opposite extreme—being fully invested with no accessible funds—creates vulnerability. The solution isn’t choosing between liquidity and growth; it’s designing a system where both coexist. I once held this all-or-nothing view, but a series of near-misses taught me otherwise. Cash, when structured intentionally, isn’t dead money—it’s optionality.

I began rethinking my approach by creating tiered liquidity buffers. The first layer is the emergency reserve, designed to cover three to six months of essential expenses. This fund remains untouched except for true emergencies like job loss or medical issues. The second layer is the opportunity reserve, a smaller but accessible pool of funds earmarked for time-sensitive investments. Unlike the emergency fund, this can be deployed when market conditions align with my strategy. The third layer is the operational buffer, a floating amount used to smooth out monthly cash flow gaps, preventing overdrafts or last-minute scrambles.

These layers aren’t static. I review them quarterly, adjusting based on income changes, market outlook, and personal goals. For example, during periods of high market uncertainty, I may increase the opportunity reserve, knowing that volatility often creates value. Conversely, in stable times, I might reallocate more toward long-term growth assets. The key is flexibility. By automating transfers into these buffers—just as one would automate retirement contributions—I ensured consistency without constant decision fatigue. This system allowed me to stay invested for growth while maintaining the agility to act when needed.

Another crucial step was improving cash flow predictability. I analyzed my spending patterns and shifted non-urgent bills to weeks when I had surplus income. I also started receiving some income earlier by using direct deposit options and minimizing delays in payment processing. These small optimizations freed up hundreds of dollars each month, which I redirected into my liquidity structure. Over time, this approach didn’t slow my wealth accumulation—it accelerated it. Because I was no longer missing opportunities, my overall returns improved. Liquidity became not a cost, but a catalyst.

Syncing Income Streams with Market Cycles

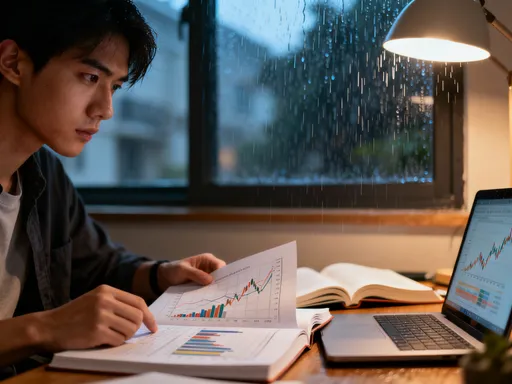

Traditional employment provides stability, but its rigid payment schedule—biweekly or monthly—often misaligns with market timing. Opportunities don’t wait for payday. To overcome this, I began diversifying my income sources to include more flexible and predictable inflows. This didn’t mean quitting my job or taking on risky ventures. Instead, I focused on supplemental streams that offered better control over when money arrived. The goal was to create a more dynamic cash flow rhythm, one that could respond to market movements rather than be constrained by payroll cycles.

One of the most effective additions was dividend-focused investments. Unlike speculative assets, dividend-paying stocks and funds provide regular income, often quarterly. By selecting companies with a history of stable or growing dividends, I created a secondary income stream that arrived on predictable dates. More importantly, I timed these inflows to precede periods of expected market volatility. For example, knowing that dividend payments would arrive in early March, I could plan to have capital available before potential mid-year corrections. This proactive alignment turned passive income into strategic fuel.

I also explored freelance consulting in my area of expertise. Unlike full-time self-employment, this allowed me to take on projects selectively, with negotiated payment terms. I structured contracts to receive a portion upfront and the remainder upon completion, giving me more control over cash timing. These gigs weren’t about maximizing income—they were about enhancing flexibility. Even a few hundred dollars from a short project could be enough to seize a small but high-conviction opportunity. Seasonal ventures, such as organizing educational workshops in the fall, added another layer of predictable income that complemented my primary job.

The result was a more resilient and responsive financial ecosystem. Instead of waiting for a single income source to fund every move, I had multiple streams with different timing patterns. This diversification smoothed out cash flow peaks and valleys, reducing stress and increasing readiness. More importantly, it gave me confidence. I no longer feared missing out because I knew my system was designed to deliver funds when I needed them. Income wasn’t just a number on a paycheck—it became a strategic asset in my wealth-building toolkit.

The Screening Framework for Real Opportunities

With better cash flow and increased readiness, a new challenge emerged: how to decide which opportunities to pursue. The market is full of noise—trending assets, viral investment ideas, and fear of missing out. Acting quickly is valuable, but only if you’re acting on the right things. I realized I needed a filter, a consistent way to evaluate whether a potential move was worth my capital and effort. Without one, I risked falling into the trap of emotional decision-making, chasing hype instead of value.

I developed a three-part screening framework: sustainability, entry feasibility, and exit clarity. Sustainability asks whether the opportunity is based on a lasting trend or temporary excitement. For example, a company benefiting from long-term demographic shifts is more sustainable than one riding a short-lived fad. Entry feasibility examines whether I can realistically participate—does it require a large minimum investment, specialized knowledge, or access to restricted markets? If the barrier is too high, even a great opportunity isn’t actionable for me. Exit clarity is perhaps the most important: do I have a clear plan for when and how to sell or close the position? An investment with no exit strategy is a gamble, not a decision.

This framework saved me from a costly mistake early on. A digital asset was gaining massive attention, with prices surging weekly. Emotionally, I wanted in. But when I applied my criteria, red flags appeared. The sustainability was questionable—no clear use case or revenue model. Entry was feasible, but exit liquidity was poor; few buyers existed outside the hype cycle. I walked away. Within months, the asset collapsed, and many who bought at the peak were unable to sell. My discipline protected my capital.

Over time, this screening process became second nature. I now apply it to every potential move, no matter how small. It doesn’t guarantee profits, but it eliminates impulsive choices and focuses my energy on high-conviction opportunities. More importantly, it allows me to act quickly when the conditions are right, because I’ve already done the thinking in advance. Preparation, once again, is the true advantage.

Risk Control: Protecting Capital While Moving Fast

Speed without discipline is dangerous. I learned this after rushing into a private investment without fully understanding the risks. The opportunity seemed strong, and I had the funds ready. But I failed to model worst-case scenarios or set clear limits. When the venture underperformed, I held on too long, hoping for a recovery that didn’t come. The loss wasn’t catastrophic, but it was avoidable. That experience taught me a vital lesson: agility must be paired with structure. The goal isn’t just to move fast—it’s to move safely.

I now approach every opportunity with predefined risk controls. First, I set a maximum allocation—no single investment can exceed a fixed percentage of my liquid capital. This ensures that even if one move fails, it won’t derail my overall financial health. Second, I establish stop triggers: clear conditions under which I will exit, such as a price drop below a certain level or a change in the underlying fundamentals. These aren’t emotional decisions—they’re rules I set in advance. Third, I conduct time-bound reviews. Every active position is reassessed at regular intervals, forcing me to re-evaluate rather than hold out of inertia.

Diversification remains a cornerstone of my strategy. I spread investments across asset types—stocks, bonds, real estate funds—and across timeframes. Some are long-term holdings, others are tactical plays with defined end dates. This balance reduces exposure to any single risk. I also avoid leveraging or borrowing to increase position size. While debt can amplify gains, it also magnifies losses and undermines the very liquidity I work so hard to maintain.

These controls don’t slow me down—they enable me. Because I have clear boundaries, I can act decisively without second-guessing. I know my limits, so I don’t panic when markets dip. Risk management isn’t about avoiding all danger; it’s about knowing which risks are worth taking and how to contain them. This disciplined approach has allowed me to pursue opportunities with confidence, knowing that my principal—the foundation of all future gains—is protected.

From Strategy to Habit: Making It Stick

Knowledge without action is meaningless. I’ve read countless financial books and attended seminars, but real change only came when I turned insights into habits. The biggest challenge wasn’t understanding the strategies—it was implementing them consistently. At first, tracking cash flow, maintaining reserves, and screening opportunities felt like extra work. But I started small. I automated the transfer of 5% of each paycheck into my opportunity reserve. I scheduled a monthly review to assess market conditions and my readiness. I kept a simple journal to record decisions, outcomes, and lessons learned.

These small actions built momentum. Within six months, they became routine. I no longer had to think about whether to save or review—I just did. The system began running itself. More importantly, my mindset shifted. I stopped seeing money as something that happened to me and started seeing it as something I could shape. I wasn’t waiting for a windfall or a miracle investment. I was operating from a position of constant readiness, where every decision reinforced the next.

Today, this approach is no longer a strategy—it’s a way of life. I don’t measure success by a single big win, but by the consistency of small, smart moves. The real victory isn’t in catching one market dip; it’s in building a financial system that allows me to do it repeatedly, without stress or recklessness. Cash flow and market awareness aren’t separate skills—they’re interconnected parts of a sustainable wealth-building engine.

For anyone feeling stuck in the paycheck-to-paycheck cycle, know this: you don’t need a higher income to gain control. You need a better structure. By rethinking how money flows in and out of your life, you create space for opportunity. You gain the ability to act when others hesitate. And over time, those moments of clarity and readiness compound into lasting financial freedom. It’s not about gambling. It’s about being prepared—so when the market offers a chance, you’re not just watching. You’re ready to act.