How I Mastered My Money While Climbing the Degree Ladder

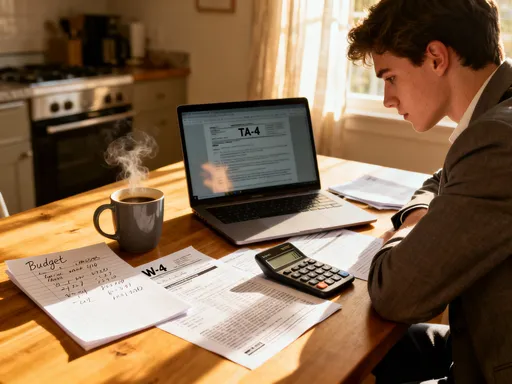

Ever felt like pursuing a higher degree drains your wallet faster than your motivation? I’ve been there—juggling tuition, side gigs, and the fear of drowning in debt. But what if you could advance your education *and* grow your wealth at the same time? It’s not magic—it’s strategy. This is how I built a system to fund my degree upgrade without sacrificing my financial future. By treating education as an investment rather than an expense, I learned to align my financial habits with long-term goals. The journey wasn’t easy, but with careful planning, disciplined saving, and smart income choices, I turned a potentially draining experience into a wealth-building phase. This story isn’t about privilege or luck. It’s about practical steps anyone can take to stay financially stable while earning a higher degree.

The Hidden Cost of Degree Advancement

When most people think about going back to school, their minds go straight to tuition bills. But the true cost of a higher degree stretches far beyond the price tag on a course catalog. There are indirect and often overlooked expenses that quietly erode financial stability. For instance, many students reduce their work hours or leave full-time jobs to accommodate class schedules, leading to a significant drop in monthly income. This opportunity cost—what you give up to pursue education—can be just as impactful as direct expenses. A person earning $4,000 a month who cuts back to part-time work may lose $1,500 or more each month over the course of a two-year program. That’s nearly $36,000 in lost earnings, not counting benefits like health insurance or retirement contributions.

Beyond lost income, there are lifestyle adjustments that add up. Relocating for a program means new housing costs, utilities, and transportation. Even staying in place can mean higher spending on food, books, technology, and childcare. These costs don’t always appear in official budgets, but they affect daily life. One study by the National Center for Education Statistics found that non-tuition expenses account for nearly 60% of total education costs for graduate students living off-campus. That means for every dollar paid in tuition, an additional 60 cents is spent on living expenses. These figures highlight why a narrow focus on tuition alone can lead to financial blind spots.

The psychological toll of financial uncertainty also plays a role. Constantly worrying about money can reduce academic performance, increase stress, and even lead to burnout. Financial anxiety is one of the top reasons students delay or drop out of degree programs. Without a clear picture of total costs—including both direct and indirect expenses—learners risk making decisions based on emotion rather than logic. This reactive mindset sets the stage for poor financial choices, such as relying too heavily on credit cards or taking out high-interest private loans. The result? A degree that comes with long-term debt and delayed financial freedom.

Recognizing the full scope of educational costs is the first step toward financial control. It shifts the conversation from “Can I afford tuition?” to “Can I sustain this lifestyle for the next two to four years?” This broader view allows for proactive planning. Instead of scrambling when a bill arrives, students can anticipate needs and build buffers. By mapping out all potential expenses—rent, food, transportation, childcare, technology, and lost income—learners gain clarity. This awareness creates space for strategy, not just survival. When you see the full financial picture, you can make informed decisions about program length, pacing, and funding sources. That’s the foundation of financial resilience during education.

Why Wealth Management Matters More Than Ever During Education Upgrades

Earning a higher degree is often framed as a guaranteed path to better pay and career advancement. And while data from the U.S. Bureau of Labor Statistics shows that advanced degree holders do earn more on average, the return on investment isn’t automatic. Without sound wealth management, even a prestigious degree can come with financial strain rather than freedom. The key is to treat education not as a cost, but as a financial project—one that requires budgeting, timeline planning, and risk assessment. Just like a business evaluates a new venture, students should evaluate their degree path with the same level of financial scrutiny.

Too often, learners approach education with a passive mindset: “I’ll figure it out as I go.” But this reactive approach leads to last-minute borrowing, overspending, and stress. A more effective strategy is to apply basic financial principles early. Start by defining your goals: Is the degree meant to change careers, increase income, or gain specialized knowledge? Each goal has different financial implications. A career switch may require relocation or additional certifications, while a salary boost might depend on graduating debt-free to maximize take-home pay. Aligning your financial plan with your purpose increases the likelihood of a positive outcome.

Another critical shift is viewing yourself as an investor in human capital. Your time, effort, and money are being put toward improving your skills and market value. Like any investment, this carries risk and potential return. The risk includes time away from the workforce, upfront costs, and the possibility that the job market may not reward the degree as expected. The return comes in the form of higher earnings, job security, and career flexibility. To maximize returns, you need to minimize unnecessary costs and avoid financial setbacks that could delay or derail your progress.

Wealth management during education means making intentional choices. It means saying no to lifestyle inflation—such as moving into a more expensive apartment because you’re “deserving”—and yes to budgeting, saving, and tracking spending. It means using financial tools like spreadsheets or budgeting apps to monitor cash flow. It also means building credit wisely, avoiding high-interest debt, and protecting your financial health. When you manage your money with discipline during school, you graduate not just with a diploma, but with stronger financial habits. These habits become the foundation for long-term wealth, turning education into a true stepping stone rather than a financial burden.

Building a Financial Foundation Before Enrollment

Starting a degree program without a financial plan is like setting sail without checking the weather or packing supplies. You might reach your destination, but the journey will be riskier and more stressful. The most successful students don’t wait until classes begin to think about money—they start preparing months in advance. The first step is a complete financial assessment. This means listing all current assets—savings, investments, and income sources—and all liabilities, including loans, credit card balances, and recurring bills. This snapshot gives you a clear starting point and helps you understand how much financial runway you have.

Once you know your current position, the next step is to create a realistic funding plan. This plan should cover all projected expenses for the duration of the program, including tuition, fees, books, technology, housing, food, transportation, and personal costs. Use official estimates from the school as a baseline, but also talk to current students or alumni to get a real-world picture. Many underestimate costs because they rely only on published numbers, which often exclude incidentals. For example, a laptop may not be listed as a fee, but it’s essential for online classes. Childcare, if applicable, can add hundreds per month. Including these in your budget prevents surprise shortfalls.

A key part of the funding plan is aligning income with expenses. Identify all possible sources of income: personal savings, spousal support, employer tuition assistance, scholarships, grants, and part-time work. Then, compare total expected income to total expected costs. If there’s a gap, you have time to address it before enrollment. Options include increasing savings, applying for more scholarships, choosing a less expensive program, or adjusting your pace—such as enrolling part-time to maintain full-time work. Starting slow is not failure; it’s strategy. Many students complete degrees faster overall by avoiding burnout from overcommitment.

Another essential step is building an emergency fund. Life doesn’t stop when you go back to school. Cars break down, medical bills arrive, and jobs can change. Without a buffer, these events force students to rely on credit cards or loans, increasing debt. A reserve of even $1,000 to $2,000 can prevent small setbacks from becoming crises. Some students set up automatic transfers to a separate savings account months before starting, treating it like a monthly tuition payment. This discipline builds financial confidence and reduces anxiety. When you know you have a cushion, you can focus on learning, not survival.

Earning While Learning: Smart Income Strategies That Don’t Burn You Out

For many students, especially those in mid-career or with family responsibilities, quitting work entirely isn’t an option. The challenge is finding ways to earn income without sacrificing academic performance or personal well-being. Not all side jobs are created equal. Some drain energy with little return, while others provide both income and long-term value. The goal is to choose work that complements your studies, not competes with them. This means prioritizing flexibility, relevance, and sustainability.

One effective strategy is freelance work in your field of study. If you’re pursuing a degree in education, tutoring part-time allows you to apply classroom theories in real time. If you’re studying business, offering consulting services to small firms helps build a portfolio. These roles not only generate income but also enhance your resume. Unlike unrelated jobs—such as waiting tables or retail work—field-aligned gigs contribute to career momentum. They provide networking opportunities, references, and practical experience that employers value. Over time, this dual benefit accelerates professional growth far more than temporary paychecks.

Remote internships are another smart option. Many graduate programs now offer credit-bearing internships that pay stipends or hourly wages. These positions allow you to gain industry experience while earning money. Because they’re often flexible and tied to academic calendars, they fit more naturally into a student schedule. Some organizations even convert interns to full-time employees after graduation, giving you a head start in the job market. The key is to seek paid opportunities early and apply strategically, treating each application like a professional endeavor.

Other low-effort, high-return options include creating digital products, such as study guides or templates, and selling them online. A nursing student might design care plan templates; a finance student could create budgeting spreadsheets. These require upfront effort but generate passive income over time. Similarly, teaching workshops or webinars on topics you’re learning can build authority and bring in fees. The common thread in all these strategies is leverage: using your knowledge to create value that pays more than hourly labor. By focusing on scalable, skill-based income, students can reduce financial pressure without burning out.

Controlling Risk: Avoiding Debt Traps and Financial Pitfalls

Debt is often unavoidable when pursuing higher education, but not all debt is equal. Federal student loans with low interest rates and flexible repayment terms can be a responsible choice. However, relying on high-interest private loans, credit cards, or personal lines of credit can lead to long-term financial strain. The danger lies in normalizing debt without a clear plan for repayment. Many students tell themselves, “I’ll worry about it later,” only to face overwhelming balances after graduation. Controlling risk means making conscious borrowing decisions and protecting your financial health throughout the program.

One common pitfall is lifestyle inflation. As students receive loan disbursements, some treat the extra funds as disposable income, upgrading their cars, moving to nicer apartments, or increasing leisure spending. But these choices increase monthly obligations and delay financial freedom. A better approach is to live below your means, even when you have access to funds. Staying in your current home, using public transportation, and cooking at home may not feel exciting, but they preserve capital. Every dollar saved during school is a dollar less to repay later.

Another risk is neglecting credit health. Late payments on bills or loans, even small ones, can damage your credit score. A lower score affects future opportunities, such as qualifying for a mortgage or securing lower insurance rates. Students should monitor their credit reports annually and set up automatic payments to avoid missed deadlines. Using a secured credit card responsibly—charging small amounts and paying in full—can also build credit safely. Financial tools like credit monitoring services or budgeting apps help maintain awareness and control.

Unexpected events, such as medical issues or job loss, can also threaten financial stability. That’s why having an emergency fund is not optional—it’s essential. Even a modest buffer reduces the need to borrow in a crisis. Additionally, understanding your loan terms is critical. Know your grace periods, repayment plans, and forgiveness options. For example, income-driven repayment plans can lower monthly payments based on earnings, making debt more manageable. By staying informed and proactive, students can navigate challenges without derailing their financial future.

Growing Wealth Alongside Your Degree: Simple Investment Habits That Work

Many students believe investing is only for those with high incomes. But wealth building doesn’t require large sums—it requires consistency. Even with a tight budget, small, regular investments can grow significantly over time thanks to compound interest. The key is to start early and automate the process. For example, setting up a monthly transfer of $25 to a Roth IRA or a micro-investing app turns spare change into long-term assets. Over ten years, that small amount could grow to over $4,000, assuming a modest 7% annual return.

One effective method is automated micro-investing. Apps like Acorns or Stash round up everyday purchases and invest the difference. If you buy a $3.50 coffee, the app invests the extra $0.50. These small amounts add up without feeling like a sacrifice. More importantly, they build the habit of investing. For students, this routine reinforces financial discipline and creates a mindset of growth. Over time, the portfolio grows not from big wins, but from steady, consistent action.

Another strategy is using tax-advantaged accounts. If you have any earned income—even from a part-time job or freelance work—you can contribute to a Roth IRA. The money grows tax-free, and withdrawals in retirement are also tax-free. While retirement may seem far off, starting early gives your investments decades to compound. A 25-year-old who invests $200 a month could have over $500,000 by age 65, assuming average market returns. Even contributing $50 a month makes a difference. The lesson is clear: start small, but start now.

Reinvesting side income is another powerful habit. Instead of spending every dollar earned from tutoring or freelancing, allocate a portion—say 20%—to savings or investments. This creates a feedback loop: your skills generate income, and that income builds wealth. Over time, these small actions compound into real financial progress. By graduation, you’re not just degree-ready—you’re wealth-ready.

From Student to Strategist: Creating Long-Term Financial Momentum

Graduation marks the end of one chapter, but it’s also the beginning of a new financial phase. The habits and systems you built during your degree journey don’t have to end—they can become the foundation for lifelong financial success. The transition from student to professional is a powerful moment. With a higher degree, your earning potential increases. But without a plan, that extra income can easily disappear into lifestyle upgrades or debt repayment. The goal is to use your increased income strategically, not just to pay back what you owe, but to build forward momentum.

Start by aligning your post-graduation income with a clear financial roadmap. Prioritize high-interest debt repayment while maintaining minimum payments on federal loans. Use windfalls—such as signing bonuses or tax refunds—to accelerate progress. At the same time, continue building your emergency fund until it covers three to six months of expenses. This buffer protects you during job transitions or unexpected costs. As your financial stability grows, shift focus to long-term goals: saving for a home, investing in retirement, or funding your children’s education.

The discipline you developed during school—budgeting, tracking spending, and managing time—translates directly into professional life. These skills give you an edge in financial decision-making. You’re less likely to overspend, more likely to save, and better equipped to handle economic changes. Employers value this discipline too. Financially stable employees tend to be more focused, less stressed, and more productive. Your degree opened the door, but your financial habits keep you moving forward.

Degree advancement is more than a credential. It’s a transformation—one that includes not just knowledge, but mindset and behavior. When you combine education with smart money management, you create a powerful synergy. You don’t just earn more—you keep more, grow more, and live with greater confidence. The journey isn’t about perfection. It’s about progress. By making thoughtful choices today, you build a future where financial strength and personal growth go hand in hand. That’s the real return on investment.