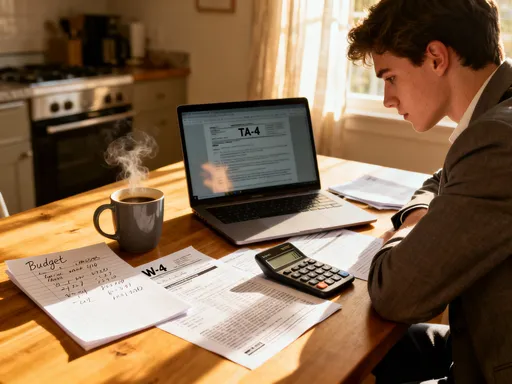

How I Keep More of My Stock Gains — A Real Tax-Smart Investor’s Journey

Ever sold a stock and felt a punch when seeing how much went to taxes? I’ve been there. After years of trial and error, I learned smart tax strategies aren’t just for experts. By aligning moves with tax logic, I kept more gains and avoided costly mistakes. This isn’t about loopholes—it’s practical, proven thinking. Let me walk you through the approach that changed my investing game, step by step, in plain terms anyone can follow. The truth is, many investors focus only on returns without considering what they keep after taxes. But a dollar earned is not the same as a dollar kept. Over time, tax efficiency can make the difference between modest growth and lasting wealth. What follows is not a theoretical guide, but a real-world journey—how one investor, like many, learned to respect the tax impact and turn it into a quiet advantage.

The Wake-Up Call: When Taxes Took Too Much

It started with a single trade—one that should have felt like a victory. I had bought shares in a mid-sized tech company during a market dip, watched them climb steadily over eight months, and sold near the peak. The profit looked impressive on paper: nearly 35% return in less than a year. But when tax season arrived, the excitement faded fast. What I thought was a tidy gain turned into a much smaller number after federal and state taxes applied the short-term capital gains rate. I was in the 24% federal bracket at the time, and my state added another 5%. Combined, I lost almost a third of my profit to taxes—money I hadn’t budgeted to lose.

That moment was a wake-up call. I had treated the sale like a win, but the tax outcome revealed a flaw in my thinking: I hadn’t considered timing or tax classification at all. I sold based on price, not on how the gain would be taxed. Like many investors, I viewed taxes as an unavoidable afterthought—an inevitable cost of success. But this experience showed me that tax impact isn’t passive; it’s something you can plan for, and even reduce, with foresight. The IRS doesn’t tax all gains the same way, and that distinction creates room for strategy. The key is understanding the rules not to avoid paying what’s due, but to avoid overpaying what isn’t.

What I learned next reshaped my entire approach. The U.S. tax code treats capital gains in two distinct ways: short-term and long-term. If you hold an asset for one year or less, any profit is taxed at your ordinary income rate—the same rate that applies to your salary. But hold that same stock for more than a year, and the gain qualifies for the long-term capital gains rate, which is significantly lower for most taxpayers. For someone in the 24% income bracket, the long-term rate could be as low as 15%. That difference—24% versus 15%—isn’t just a number. It’s real money, and in my case, it meant the difference between keeping $760 or $850 of every $1,000 in gains. That extra 9% retention adds up over time, especially when reinvested. I realized then that investing isn’t just about picking winners—it’s about holding them the right way.

From that point on, I stopped viewing tax planning as something for accountants or the ultra-wealthy. It became part of my regular investment checklist. Before selling anything, I now ask: How long have I held this? What tax bracket am I in? Could waiting a few more weeks reduce my rate? These questions don’t guarantee profits, but they do protect them. And that shift—from reactive to proactive—marked the beginning of a more disciplined, tax-aware investing life.

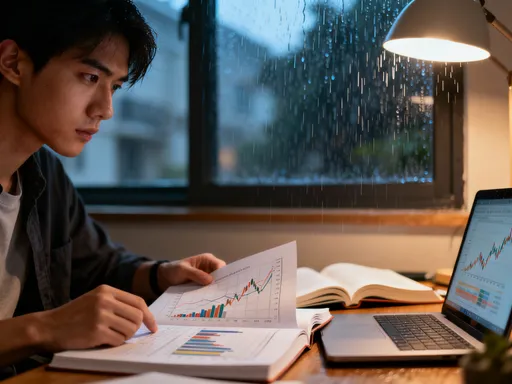

Understanding the Two Sides of Capital Gains

At the heart of tax-smart investing is a simple but powerful distinction: short-term versus long-term capital gains. This isn’t a complex financial theory; it’s a rule written into the tax code that affects every investor who sells stocks, ETFs, or mutual funds. The dividing line is clear—365 days. Hold an investment for one year or less, and any profit is taxed as short-term gain, at your regular income tax rate. Hold it for more than a year, and the profit qualifies as long-term gain, taxed at a lower rate. For most middle- and upper-middle-income earners, that lower rate is either 0%, 15%, or 20%, depending on taxable income. The gap between these rates and ordinary income rates can be substantial.

I began reviewing my past trades with this lens, and the pattern was unmistakable. Almost every time I had sold quickly—within months—after a strong run, I had paid more in taxes than necessary. One example stands out: a biotech stock I bought during a market correction. It surged 40% in nine months, and I sold, thrilled. But because I was under the one-year mark, the entire gain was taxed as ordinary income. Had I simply waited five more weeks, I would have crossed into long-term territory and saved nearly $1,200 on that single trade. That wasn’t lost profit—it was lost patience. The market didn’t punish me; my own timing did.

This realization changed how I think about investment timelines. I now treat the one-year mark as a strategic milestone, not just a calendar date. When a stock approaches that threshold, I evaluate whether selling makes sense—not just from a price perspective, but from a tax one. Sometimes, the smart move is to wait. Other times, if fundamentals have changed or the stock has reached a true peak, I accept the higher tax as the cost of timely decision-making. But the key is making that choice consciously, not by accident.

The long-term rate isn’t just a discount—it’s a reward for patience and discipline. The government offers this incentive to encourage long-term investing, which stabilizes markets and supports economic growth. By aligning with that goal, investors can benefit twice: through compounding growth and through lower tax drag. I’ve come to see the holding period as a lever—one that, when pulled at the right time, can significantly boost after-tax returns. It’s not about holding forever, but about holding long enough to qualify for the better rate. That small adjustment in timing has become one of the most reliable tools in my investing toolkit.

Harvesting Losses Without the Hype

Tax-loss harvesting is a term that sounds like something only Wall Street professionals do. When I first heard it, I assumed it involved complex algorithms and high-frequency trading. But in reality, it’s a straightforward strategy that any investor can use: selling investments that have declined in value to realize a loss, then using that loss to offset capital gains elsewhere in your portfolio. The goal isn’t to time the market, but to reduce your tax bill in a disciplined way. I tested it during a volatile year when several of my holdings dropped. Instead of just waiting for recovery, I reviewed each position and decided to sell a few that had little near-term upside. The losses weren’t pleasant, but they weren’t wasted—they became tax assets.

Here’s how it worked in practice. In one taxable account, I had two stocks: one that was up 25% and another down 18%. I planned to sell the winner to lock in gains, but doing so would trigger a tax bill. Then I realized I could sell the losing position first, use the loss to offset the gain, and reduce or even eliminate the tax on the profitable sale. That year, I offset $3,200 in gains with $2,800 in losses, lowering my taxable income and saving hundreds in taxes. The IRS allows you to use capital losses to offset capital gains dollar for dollar, and if your losses exceed your gains, you can deduct up to $3,000 from ordinary income. Any remaining loss carries forward to future years.

But there’s a critical rule to follow: the wash-sale rule. If you sell a stock at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the IRS disallows the loss for tax purposes. I learned this the hard way when I sold a fund at a loss and repurchased it two weeks later, thinking I was reinvesting wisely. My accountant flagged it—my loss didn’t count. Now, I either wait 31 days or replace the holding with a similar but not identical investment. For example, if I sell a U.S. large-cap ETF at a loss, I might buy a different one that tracks a similar index but isn’t identical. This keeps me invested while staying compliant.

Tax-loss harvesting isn’t about panic selling or abandoning strategy. It’s a tactical move, best used when you already have reason to exit a position. I don’t force it—I look for natural opportunities. And I always document the trades carefully. Over time, this practice has smoothed my tax bills, especially in down years. It turns some of the pain of market drops into a benefit. That doesn’t make losing money acceptable, but it does make it less costly.

The Power of Holding: Letting Time Work For You

One of my most valuable lessons came from a stock I almost sold too early. I bought shares in a consumer goods company six years ago, drawn by its steady dividends and strong brand. Over time, the stock climbed—slowly at first, then more sharply as earnings grew. After three years, it had doubled. I was tempted to sell, lock in the profit, and move on. But something held me back. I ran the numbers and realized that selling then would mean paying short-term rates on any future gains if I reinvested. More importantly, I was already deep into long-term territory—the tax rate was locked in at 15%, and every additional dollar of growth would be taxed at that favorable rate.

I decided to hold. Over the next three years, the stock tripled from my original purchase price. When I finally sold half to rebalance, the tax hit was minimal compared to the gain. Because every dollar of profit had been held for more than five years, it qualified for the long-term rate. The compounding effect wasn’t just in price—it was in tax efficiency. By staying patient, I allowed time to work on two fronts: investment growth and tax savings. That single decision added thousands of dollars to my net proceeds.

This experience taught me that holding isn’t passive. It’s an active strategy when done with intention. I now set minimum holding periods for new purchases—three years for growth stocks, five for core holdings. This doesn’t mean I never sell early, but it forces me to justify the decision. Am I selling because the story has changed? Or just because I’m eager for a win? That pause has saved me from premature exits more than once.

The longer you hold, the more tax efficiency compounds. Each year of growth builds on the last, and because long-term gains are taxed lightly, more of that growth stays in your pocket. It’s a quiet advantage—one that doesn’t show up in headlines but shows up clearly on tax returns. I’ve come to view patience not as waiting, but as a form of strategic action. And in the world of investing, where so much feels unpredictable, it’s one of the few levers you truly control.

Smart Account Choices: Where You Invest Matters

Not all investment accounts are created equal when it comes to taxes. I used to keep all my stocks in a regular taxable brokerage account, not realizing that some assets are better suited for tax-advantaged spaces. Then I learned about asset location—the practice of placing different types of investments in the most tax-efficient accounts. It’s a simple idea with powerful results. Taxable accounts generate annual tax bills on dividends and capital gains. But IRAs, Roth IRAs, and 401(k)s offer different tax treatments that can reduce or eliminate that friction.

I started by moving high-growth, high-turnover investments—like small-cap stocks and sector ETFs—into my Roth IRA. These assets have the potential for large gains, and in a Roth account, those gains grow tax-free and can be withdrawn tax-free in retirement. That means no capital gains taxes ever. Meanwhile, I kept dividend-paying blue-chip stocks in my taxable account. Why? Because qualified dividends are taxed at the same favorable rates as long-term capital gains—15% for most taxpayers. And if your income is low enough, they may be taxed at 0%. So while they generate annual income, the tax cost is relatively low.

I also reviewed my bond holdings. Interest from most bonds is taxed as ordinary income, which can be costly in a taxable account. I shifted most of my bond funds into my traditional IRA, where they grow tax-deferred. Now, the interest compounds without annual tax drag, and I’ll pay taxes only when I withdraw in retirement—likely at a lower rate. This kind of strategic placement doesn’t require complex math, but it does require intention. I didn’t overhaul everything at once. I made adjustments gradually, as I rebalanced or rolled over old accounts.

The principle is simple: match the tax characteristics of the asset with the tax treatment of the account. Growth assets go where they won’t be taxed annually. Income assets go where their tax burden is lowest. This isn’t about tax avoidance—it’s about tax efficiency. Over time, the difference in after-tax returns can be significant. I’ve seen it in my own portfolio: the same investments, held in different accounts, produce different net outcomes. By optimizing location, I’ve reduced my annual tax drag and increased my long-term wealth.

Planning Sales: Timing Is More Than Luck

Selling used to be an emotional decision for me—driven by fear, greed, or momentum. Now, it’s a planned one. I still watch the market, but I also watch the calendar, my income, and my tax bracket. These factors help me decide not just *whether* to sell, but *when*. For example, if I’m close to the edge of a higher tax bracket, I might delay a sale until the next year to avoid jumping into a 32% rate instead of staying in 24%. That small delay can save hundreds or even thousands.

Conversely, in a year when my income is lower—perhaps due to a career break or reduced hours—I might choose to realize gains intentionally. Because tax brackets are based on annual income, a low-earning year can create space to lock in gains at a lower or even 0% long-term capital gains rate. I did this two years ago when I took time off to care for a family member. My taxable income was below the threshold for the 15% rate, so I sold a few long-held winners and paid no federal capital gains tax. That kind of opportunity only comes once in a while, but it’s worth planning for.

I also coordinate sales with tax-loss harvesting. If I know I have gains coming, I’ll look for offsetting losses ahead of time. I don’t force the loss, but I stay aware of underperforming holdings. This proactive approach turns tax planning from a year-end scramble into a year-round practice. I keep a simple spreadsheet tracking cost basis, purchase dates, and unrealized gains or losses. Before any sale, I review it. That habit has helped me avoid costly mistakes and make smarter decisions.

Timing isn’t about predicting the market. It’s about aligning your actions with your financial reality. A well-timed sale doesn’t just lock in profit—it preserves it. And in the long run, that’s what builds wealth: not just earning returns, but keeping them.

Staying Compliant and Confident

None of what I’ve described involves hiding money, exploiting loopholes, or bending the rules. Every strategy I use is fully compliant with IRS regulations. I keep detailed records of every trade—purchase dates, sale dates, cost basis, and tax forms. I use tax software that integrates with my brokerage accounts, ensuring accuracy. And I consult a tax professional every year to review my plan. This isn’t about fear of audits; it’s about peace of mind. I want to optimize, not risk penalties.

Over time, I’ve built a system that works within the rules and supports my goals. I still buy and sell stocks. I still take profits and accept losses. But now, I do it with awareness. I think in terms of after-tax returns, not just pre-tax gains. I plan for the long term, but I act with tax efficiency in mind. This mindset hasn’t made me rich overnight, but it has made me wealthier over time. The difference isn’t in big wins—it’s in small, consistent choices that add up.

Tax-smart investing isn’t magic. It’s not reserved for the wealthy or the well-connected. It’s available to anyone who takes the time to understand the rules and apply them with discipline. For me, it started with a single lesson: every dollar saved in taxes is a dollar earned. That shift in perspective changed everything. I stopped seeing taxes as an enemy and started seeing them as a factor to manage. And in doing so, I’ve kept more of what I’ve worked for. That’s not just smart investing—that’s smart living.