How I Survived the Financial Emergency — Smart Cost Control That Actually Works

What happens when your income vanishes overnight? I’ve been there — job loss, medical crisis, the whole panic spiral. That’s when I learned real cost control isn’t about skipping coffee; it’s about strategic survival. This isn’t theory — it’s what saved me. In this article, I’ll walk you through the professional-grade methods that kept me afloat, focusing on what truly matters: protecting your finances when everything else falls apart. These are not quick fixes or trendy hacks. They are structured, disciplined approaches grounded in financial reality, tested under pressure, and proven to work when the stakes are highest. If you’ve ever felt one missed paycheck away from disaster, this is your roadmap to resilience.

The Wake-Up Call: Facing a Real Financial Crisis

It started with a layoff email — two sentences, no warning. One moment I was planning next quarter’s goals; the next, I was staring at a blank screen, heart racing, wondering how I’d cover the mortgage. Within days, a family medical issue compounded the stress, turning a temporary setback into a full-blown financial emergency. The savings I thought were sufficient barely lasted six weeks. What followed was a period of sleepless nights, mounting bills, and the suffocating realization that my financial safety net had holes I never noticed.

This experience wasn’t unique, but my response had to be. Like many, I had relied on general budgeting — tracking expenses, setting limits on dining out, using a savings jar. But none of that prepared me for a true income shock. I soon realized that traditional budgeting is designed for stability, not survival. When your primary income disappears, the rules change. Suddenly, every dollar must serve a purpose, and emotional spending — the impulse to soothe stress with small comforts — becomes a dangerous liability. Panic sets in, and without a clear plan, people default to reactive decisions that worsen the situation.

Research supports this pattern. Studies show that nearly 60% of households would struggle to cover a $1,000 emergency expense, and more than a third have no emergency savings at all. When crisis hits, most people operate on instinct, not strategy. They delay tough decisions, avoid opening bills, or make short-term trade-offs that damage long-term stability — like withdrawing from retirement accounts or maxing out credit cards. The real failure isn’t the lack of money; it’s the lack of a structured response. Without a framework for action, even financially responsible individuals can spiral into deeper distress.

The turning point for me came when I stopped asking, How do I cut more? and started asking, What absolutely must be paid, and why? This shift in mindset — from passive reduction to active prioritization — became the foundation of my recovery. I stopped treating all expenses as equal and began evaluating each one through the lens of survival. This wasn’t about austerity for its own sake; it was about preserving resources for what truly mattered. And that clarity allowed me to act with purpose, not fear.

The Core Principle: Separating Survival from Lifestyle

When a financial emergency strikes, the first and most critical step is to redefine what “necessary” means. In normal times, we blur the line between survival and comfort. Streaming services, gym memberships, even regular grocery deliveries — these feel essential because they’re part of our routine. But in a crisis, that distinction collapses. True necessities are limited to housing, utilities, basic food, essential transportation, and critical healthcare. Everything else, no matter how ingrained in daily life, becomes negotiable.

Recognizing this difference is not just practical — it’s psychological. Many people fail in emergencies because they try to maintain their pre-crisis lifestyle while cutting only the most visible luxuries. They cancel a $15 coffee subscription but keep a $75 monthly fitness class they no longer attend. The real savings lie in confronting the larger, less visible costs that masquerade as necessities. The mental shift required is profound: it means accepting that temporary sacrifice is not failure, but strategy.

I began by categorizing all my monthly expenses into three tiers: non-negotiable, adjustable, and eliminable. Non-negotiables included rent, electricity, internet (critical for job searching), and groceries focused on nutrition, not convenience. Adjustable costs were things like insurance premiums, phone plans, and car payments — items that could be renegotiated or temporarily modified. Eliminable expenses were subscriptions, entertainment, dining out, and non-essential shopping. This simple framework removed emotion from the decision-making process. Instead of asking, Can I live without this? I asked, Does this support my ability to recover? If the answer was no, it was paused or canceled.

One of the most impactful changes was renegotiating my rent. I contacted my landlord with a clear explanation of my situation, provided documentation of income loss, and proposed a temporary reduction in exchange for a longer lease commitment. To my surprise, the request was granted. Similarly, I switched to a lower-cost phone plan, canceled streaming services I rarely used, and suspended my investment contributions — not permanently, but until income stabilized. These actions weren’t about deprivation; they were about reallocating resources to protect the core. By separating survival from lifestyle, I freed up nearly 40% of my monthly outflow, buying me the time I needed to rebuild.

Building Your Emergency Firewall: The 72-Hour Action Plan

When a financial crisis hits, the first 72 hours are critical. Delaying action increases stress and reduces options. That’s why I developed a structured emergency firewall — a clear, step-by-step response plan to deploy immediately after income disruption. This isn’t about long-term solutions; it’s about stopping the financial bleeding before it becomes irreversible.

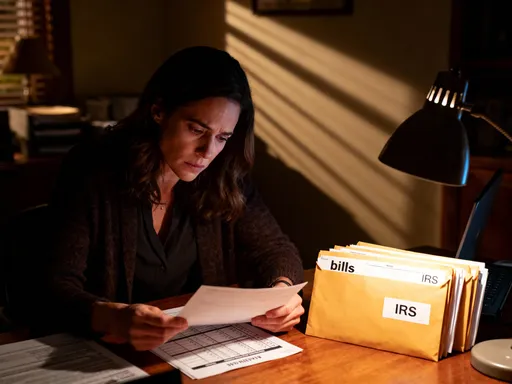

The first step is to pause non-critical payments. This includes subscription renewals, discretionary transfers, and any automated spending not tied to survival. Most digital services allow temporary suspension without penalty — use that to your advantage. Next, assess your immediate cash position. How much liquid money do you have? How long will it last if only essential expenses continue? This calculation provides a realistic timeline and helps prioritize next steps.

Simultaneously, initiate contact with creditors and service providers. Call your landlord, utility companies, internet provider, and loan servicers. Explain your situation clearly and professionally. Many companies have hardship programs that offer temporary relief, such as deferred payments, reduced rates, or extended due dates. The key is to communicate early — waiting until you’re behind reduces your credibility and limits available options. When I reached out, I was honest but composed, focusing on solutions rather than excuses. I requested specific adjustments — a two-month rent deferral, a lower electricity payment plan — and offered to provide documentation if needed. In every case, the response was more favorable than I expected.

Another essential part of the 72-hour plan is establishing a priority hierarchy for expenses. I used a tiered system: Tier 1 included shelter, food, utilities, and essential transportation; Tier 2 covered insurance and minimum debt payments; Tier 3 was everything else. This structure ensured that if funds were limited, the most critical needs were met first. I also created a daily spending log to track every dollar, eliminating guesswork and preventing small leaks. By the end of the third day, I had a clear picture of my financial position, a list of immediate actions taken, and a plan for the next 30 days. That clarity reduced anxiety and restored a sense of control.

Smart Cost Control: The Professional’s Toolkit

Once the immediate crisis is contained, the focus shifts to sustained cost control. This is where most people rely on generic advice like “cook at home” or “use coupons.” While those habits help, they’re not enough when real financial pressure hits. Professionals approach cost control with discipline, using proven tactics that deliver measurable results. These are not one-off tips — they are repeatable practices that form the backbone of financial resilience.

One of the most effective tools is tactical renegotiation. This goes beyond asking for lower bills; it involves researching competitive rates, preparing documentation, and making data-driven requests. For example, when I reviewed my insurance policies, I discovered I was overpaying by nearly 25% compared to market rates. I contacted my provider with a quote from a competitor and requested a rate match. They agreed, saving me over $1,200 annually. The same approach worked with my internet and phone plans. Companies often prefer to retain customers at a lower rate than lose them entirely — but you have to ask.

Another powerful strategy is temporary income redirection. When my primary income stopped, I redirected any incoming funds — tax refunds, side gig earnings, even gifts — directly into a dedicated emergency account. This created a buffer that insulated me from future shocks. I also paused all non-essential investments, including retirement contributions, to preserve cash. This wasn’t a long-term decision, but a short-term reallocation to ensure liquidity during the crisis. Once income resumed, I gradually reinstated those contributions, but only after rebuilding a three-month expense buffer.

Strategic use of grace periods and payment flexibility is another underused tool. Many lenders and service providers offer short-term relief options, but they’re rarely advertised. I discovered that my car loan servicer allowed a one-time three-month payment deferral without penalty. I used it wisely, aligning it with the period of zero income. Similarly, my credit card issuer offered a temporary lower interest rate for customers experiencing hardship. By proactively seeking these options, I avoided late fees, preserved my credit score, and maintained financial stability. These practices aren’t about gaming the system — they’re about using available resources intelligently.

Avoiding the Hidden Traps: Where People Lose Money

Even with a solid plan, financial emergencies are fraught with hidden risks. The most dangerous are not external — they’re behavioral. Emotional decisions, misinformation, and timing mistakes can erode savings faster than any expense. Recognizing these traps is essential to preserving what you have.

One of the most common mistakes is panic selling investments. When cash is tight, it’s tempting to liquidate retirement accounts or brokerage holdings to cover bills. But selling during market downturns locks in losses and disrupts long-term growth. I knew a woman who withdrew $15,000 from her 401(k) during a job loss, incurring taxes and penalties. She used the money to cover six months of expenses, but the long-term cost — lost compounding and retirement shortfall — far exceeded the immediate benefit. The better approach is to preserve investments and focus on reducing expenses first.

Another trap is relying on high-cost short-term loans. Payday loans, cash advances, and high-interest personal loans may seem like quick fixes, but they often lead to debt cycles that are hard to escape. Interest rates can exceed 300% annually, turning a $500 loan into thousands in repayment. I avoided this by using my emergency firewall and negotiating with creditors instead. When you’re in crisis, every dollar saved is a dollar earned — and borrowing at exorbitant rates is the opposite of earning.

Poor timing also plays a role. Some people make permanent cuts during temporary crises — canceling health insurance, selling a reliable car, or moving to a much smaller home. These decisions may save money now but create new costs later. The key is to distinguish between temporary adjustments and irreversible choices. I kept my health coverage, maintained my vehicle, and stayed in my apartment — all by negotiating terms, not abandoning them. By avoiding these hidden traps, I protected not just my finances, but my future stability.

Balancing Risk and Recovery: Protecting Future Income

Cost control during a crisis isn’t just about spending less — it’s about preserving opportunity. Every financial decision should be evaluated not only by its immediate savings but by its impact on long-term earning potential. This means protecting your credit health, maintaining professional relationships, and avoiding choices that limit future options.

Your credit score is one of your most valuable assets. Late payments, defaults, and high credit utilization can damage it for years, affecting loan approvals, interest rates, and even job prospects in some industries. That’s why I prioritized minimum payments on all debts, even when cash was tight. I communicated with lenders, set up adjusted payment plans, and avoided missed payments at all costs. I also refrained from opening new credit accounts or maxing out existing cards — actions that might provide short-term relief but harm long-term financial standing.

Equally important is protecting your employment value. During my job search, I maintained a professional appearance, continued networking, and invested in low-cost skill-building — like free online courses — to stay competitive. I didn’t cut every expense; I cut strategically, ensuring I could still present myself as a strong candidate. I also avoided burning bridges with former employers or colleagues. These intangible assets often lead to new opportunities, and preserving them paid off when a former contact referred me to a new role.

Mental resilience is another critical factor. Financial stress affects decision-making, sleep, and overall well-being. I practiced mindfulness, maintained a routine, and sought support from trusted friends. Staying emotionally balanced helped me make clearer, more rational choices. Recovery isn’t just financial — it’s psychological. By protecting both my credit and my mental health, I positioned myself not just to survive, but to rebound stronger.

From Crisis to Control: Rebuilding with Confidence

Emergencies don’t last forever, but their lessons should. Once income stabilized, I didn’t return to my old financial habits. Instead, I conducted a post-crisis review: What worked? What didn’t? Where did I make mistakes? This reflection led to concrete changes. I rebuilt my emergency fund to cover nine months of essential expenses — double my previous target. I updated my budget to include a “crisis mode” category, with pre-negotiated options and contact lists for key providers.

I also created a personal emergency protocol — a written plan outlining exactly what to do in the first 72 hours of income loss. It includes a checklist, priority tiers, and communication templates. This document removed uncertainty and gave me confidence that I could handle future shocks. I shared it with my family so everyone understood the plan, reducing stress during high-pressure moments.

The experience transformed my relationship with money. I no longer see cost control as a restriction, but as a form of empowerment. It’s not about living with less — it’s about living with intention. By mastering the principles of strategic survival, I turned a period of fear into a foundation for lasting strength. Financial emergencies will happen. What matters is not whether you face them, but how you respond. With the right tools, mindset, and discipline, you don’t just survive — you emerge in control.