How I Slashed My Debt Using Smart Tax Moves—Real Talk from the Trenches

What if paying less in taxes could actually help you crush your debt faster? I was buried under balances and stressed about every bill—until I realized I’d been ignoring a powerful tool: tax strategy. It’s not just for rich investors. Regular people like us can use smart, legal methods to keep more cash and attack debt harder. This is how I turned tax time into a debt-killing weapon—no hype, just real steps that worked. By understanding how the system rewards certain behaviors, I found hundreds of dollars I didn’t know I was leaving on the table. That money didn’t go toward another vacation or impulse buy—it went straight to my credit cards, student loans, and personal debt. Over time, those redirected funds made the difference between spinning my wheels and making real progress. This isn’t about loopholes or risky schemes. It’s about clarity, discipline, and using what’s already available to build a stronger financial foundation.

The Debt Trap I Couldn’t Escape (And Why I Needed a New Game Plan)

For years, I believed the only way out of debt was to earn more or spend less. I budgeted carefully, canceled subscriptions, cooked at home, and avoided shopping sprees. Still, my progress felt frustratingly slow. Every month, after paying the minimums on my credit cards and student loans, there was little left to make a real dent. I watched balances barely budge, even as I sacrificed comfort and convenience. The emotional toll was just as heavy—constant anxiety about due dates, overdrafts, and the fear that I’d never catch up. It wasn’t until a particularly stressful tax season that I began to question my entire approach. I received a $3,200 refund that year—money I had technically earned but hadn’t seen all year. It felt like a small victory at first, but then it hit me: I had given the government an interest-free loan worth over $250 every month. That cash could have been going toward my 19% APR credit card instead of sitting in a government account. That realization was the turning point. I started asking myself whether I could use tax planning not just to comply with the law, but to actively fuel my debt payoff. I wasn’t looking for shortcuts—I wanted sustainable, legal ways to redirect money I was already earning. What I discovered changed everything.

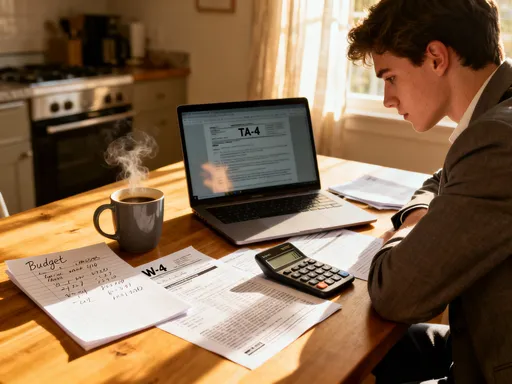

My journey into tax-smart debt repayment began with a simple audit of how I interacted with the tax system. I reviewed past returns, checked my W-4 form, and looked at every deduction and credit I had claimed—or missed. I realized I had overlooked several common benefits simply because I assumed they didn’t apply to me. For example, I qualified for the Lifetime Learning Credit based on a professional certification I’d completed, but I hadn’t filed for it. That single omission cost me $200 in potential savings. Another year, I paid several thousand dollars in qualified medical expenses but didn’t itemize because I wasn’t aware I could have exceeded the standard deduction. These weren’t complex strategies—just missed opportunities. What became clear was that most people, myself included, treat taxes as a one-day-a-year chore rather than an ongoing financial lever. Once I shifted my mindset, I started seeing tax planning as part of my broader money management system. Instead of waiting for April to act, I began making intentional decisions throughout the year to maximize what I kept—and what I could use to pay down what I owed.

Tax Strategy Isn’t Just for the Wealthy—Here’s What They Know That You Don’t

There’s a common myth that tax planning is only for accountants, business owners, or people with six-figure incomes. But the truth is, everyone pays taxes—and everyone can benefit from understanding how they work. Wealthy individuals don’t necessarily pay less because they earn more; they pay less because they structure their income and expenses in ways that reduce their taxable liability legally. They use retirement accounts, charitable contributions, business deductions, and timing strategies to lower what they owe. The good news? Many of these tools are available to average earners too. You don’t need to own real estate or run a company to benefit from tax-smart decisions. Simple actions like adjusting your withholding, claiming refundable credits, or timing large purchases can have a real impact on your cash flow. The key difference is awareness. While most people accept their tax bill as fixed, financially savvy individuals treat it as negotiable within the rules.

One of the most powerful lessons I learned was that tax optimization isn’t about avoiding responsibility—it’s about efficiency. Just like you wouldn’t ignore a discount at the grocery store, you shouldn’t ignore legal ways to reduce your tax burden. For instance, the Earned Income Tax Credit (EITC) puts billions back into the hands of low- and moderate-income families every year, yet millions fail to claim it simply because they don’t know they qualify. Similarly, the Child Tax Credit and American Opportunity Tax Credit are often underutilized, especially by single parents or part-time students. These aren’t niche benefits—they’re mainstream tools designed to help everyday people. When I started applying for every credit I was eligible for, my refund increased significantly. But instead of spending it, I treated it as a targeted debt payment. That year, I applied the full amount—over $4,000—toward my highest-interest debt. That single move shortened my payoff timeline by more than a year. The power wasn’t in earning more; it was in keeping more of what I already earned.

Another eye-opening discovery was how timing affects tax outcomes. High-income earners often defer income or accelerate deductions to manage their tax brackets. While I wasn’t earning enough to worry about jumping into a higher bracket, I realized I could use similar logic in reverse. In years when my income was higher due to a bonus or side work, I made sure to maximize deductions like medical expenses, charitable gifts, or retirement contributions. In lower-income years, I minimized deductions so I could benefit more from refundable credits. This strategic approach allowed me to smooth out my tax burden and create more predictable cash flow. More importantly, it gave me the flexibility to direct larger sums toward debt when I had the capacity. The takeaway? Tax strategy isn’t about complexity—it’s about intentionality. When you plan ahead, you stop reacting to the system and start using it to your advantage.

Finding Hidden Cash: Three Tax Moves That Fueled My Payoff Plan

The first major change I made was adjusting my W-4 withholding. For years, I had claimed fewer allowances than necessary, which resulted in larger refunds. While getting a big check in April felt rewarding, it was financially inefficient. That money could have been in my pocket each month, earning interest or reducing high-cost debt. By revising my W-4 to reflect my actual filing status, dependents, and deductions, I reduced my withholding and increased my net pay by about $180 per month. That extra cash didn’t go toward lifestyle inflation—it went straight into a dedicated debt repayment account. Over 12 months, that’s more than $2,000 redirected from the government to my creditors. The psychological shift was just as important: instead of waiting for a lump sum once a year, I had consistent fuel for my debt snowball. This small change didn’t require special knowledge or risk—it just required attention.

The second move was aggressively claiming all eligible tax credits. I spent an evening reviewing IRS Publication 970 and other official resources to identify credits I might qualify for. I discovered I was eligible for the Saver’s Credit just by contributing to my IRA, even though my contribution was modest. I also claimed the Residential Energy Efficient Property Credit after installing energy-efficient windows the previous year—something I hadn’t realized was deductible. Each of these added up. In one tax year, I recovered over $600 in credits I would have otherwise left behind. I also made sure to document everything thoroughly, keeping receipts and records in a secure folder. This wasn’t about gaming the system—it was about claiming what the law already allowed. When I added that $600 to my monthly debt payments, it accelerated my payoff date by several months. The lesson was clear: knowledge is power, and a little research can yield real financial rewards.

The third strategy was timing deductible expenses to maximize impact. I learned that certain expenses—like medical bills, mortgage interest, or home office costs—can be itemized if they exceed the standard deduction. Instead of spreading these out randomly, I began planning them strategically. For example, I scheduled major dental work in a year when I already had other medical expenses, knowing I could exceed the 7.5% of adjusted gross income threshold for medical deductions. I also bundled charitable donations into a single tax year to surpass the standard deduction and claim the full benefit. This “bunching” strategy allowed me to itemize in alternate years while taking the standard deduction in others—maximizing value without increasing spending. The extra tax savings in high-deduction years gave me a windfall I could apply directly to debt. One year, this approach freed up nearly $1,200 in additional cash flow. Again, none of this required earning more—just managing what I already had more effectively.

Timing Is Everything: How Tax Cycles Can Accelerate Debt Freedom

Tax planning isn’t a once-a-year event—it’s a year-round opportunity to influence cash flow. Once I understood this, I began aligning my financial calendar with the tax cycle. Instead of viewing April 15 as a deadline, I started treating January through December as a strategic window. I asked myself: when do I expect income changes? When will large expenses occur? How can I time these to optimize my tax outcome and debt repayment? For example, if I knew I’d receive a year-end bonus, I adjusted my withholding earlier in the year to avoid a large tax bill later. That way, I could use the bonus entirely for debt without worrying about tax obligations. Alternatively, if I anticipated a lower income year, I delayed large deductions so I could take the standard deduction and still qualify for refundable credits. This proactive approach turned tax time from a source of stress into a predictable financial lever.

Another powerful tool I used was the traditional IRA contribution. By contributing up to the annual limit before the tax filing deadline, I reduced my taxable income and lowered my tax bill. For example, putting $3,000 into an IRA not only helped me save for retirement but also decreased my adjusted gross income, potentially qualifying me for additional credits. The money wasn’t free—I was still setting it aside—but the tax savings gave me breathing room in my budget. I treated the tax reduction as a secondary benefit that allowed me to maintain or even increase my debt payments without straining my monthly cash flow. This dual-purpose strategy helped me build long-term security while attacking short-term liabilities. Over time, I found that small, consistent moves like this created compounding benefits—both in debt reduction and financial confidence.

I also learned to anticipate tax refunds as planned income rather than surprise money. Instead of spending it on travel or electronics, I committed to using at least 80% of my refund for debt repayment. To make this easier, I opened a separate savings account labeled “Tax Payoff Fund” and transferred the refund there immediately upon receipt. This created a psychological barrier against spending and ensured the money was used intentionally. In years when I owed money instead of receiving a refund, I adjusted my withholding to avoid future surprises. The goal wasn’t to eliminate refunds entirely—but to eliminate ignorance about where my money was going. By syncing my tax behavior with my debt goals, I turned a passive process into an active strategy. That shift in mindset made all the difference.

Avoiding the Pitfalls: What Not to Do When Mixing Taxes and Debt

While tax strategies can be powerful, they aren’t a license to cut corners. I made mistakes early on—like underwithholding to boost my take-home pay, only to face a large tax bill I couldn’t afford. That experience taught me a hard lesson: short-term gains can lead to long-term pain. The IRS charges interest and penalties on unpaid taxes, and those fees can erase any benefit from keeping extra cash. I now aim for accuracy, not minimization. My goal isn’t to owe nothing—it’s to owe a manageable amount that I’ve planned for. This balance keeps me compliant and stress-free. I also avoid spending money just to create a deduction. Just because a home office or medical expense is deductible doesn’t mean it’s worth incurring if I don’t need it. The objective is to reduce taxable income wisely, not recklessly.

Another common trap is taking aggressive tax positions without proper documentation. I once considered claiming a home office deduction without meeting the exclusive and regular use requirements. A conversation with a tax professional quickly set me straight—claiming deductions you don’t qualify for can trigger audits and penalties. Now, I only claim what I can prove with records, receipts, and clear eligibility. This conservative approach protects me from risk while still allowing me to benefit from legitimate opportunities. I also avoid borrowing against my refund or using refund anticipation loans, which come with high fees and interest. These products prey on people waiting for their money, and the cost often outweighs the benefit. Instead, I plan ahead and build a small emergency fund to cover gaps between paychecks and tax bills.

Finally, I’ve learned not to rely solely on tax strategies for debt relief. They’re a tool, not a solution. Budgeting, income growth, and disciplined spending remain the foundation of financial health. Tax savings can accelerate progress, but they can’t replace the need for a solid financial plan. I use tax optimization to enhance my strategy, not substitute for it. By keeping expectations realistic and actions compliant, I’ve been able to make steady, sustainable progress without exposing myself to risk. The goal isn’t to outsmart the system—it’s to work within it to achieve greater freedom.

Building the System: How to Make Tax-Smart Debt Payoff a Habit

To make these changes stick, I created a simple annual routine. Every December, I review my income, expenses, deductions, and debt balances. I update my W-4 if needed, plan for next year’s credits, and set a target for IRA contributions. I also meet with a tax preparer for a quick consultation, not to file early, but to identify opportunities and avoid mistakes. This proactive check-in takes less than two hours but saves me hundreds in potential oversights. I pair this with a debt tracker that shows my progress, including how much of my payoff came from tax-optimized cash flow. Seeing that visual progress keeps me motivated and accountable.

I also automate as much as possible. I set up direct deposit splits so part of my paycheck goes straight to my debt account. I schedule reminders for key tax deadlines and contribution cutoffs. These small systems reduce decision fatigue and ensure consistency. Over time, these habits became automatic—like brushing my teeth or locking the door at night. I don’t think about whether to adjust my withholding; I just do it. I don’t debate whether to claim a credit; I research it and apply. This consistency has been the real key to success. It’s not about one big win—it’s about hundreds of small, smart choices that compound over time.

The emotional benefit has been just as valuable as the financial one. I no longer feel powerless or overwhelmed by money. I have a plan, a process, and a sense of control. Tax season used to be a source of dread; now it’s a checkpoint in my financial journey. I look forward to seeing how much I’ve saved, how much debt I’ve eliminated, and how much closer I am to true financial freedom. That shift didn’t happen overnight—but it happened because I stayed consistent, stayed informed, and stayed focused on my goals.

From Surviving to Thriving: How This Shift Changed My Entire Financial Mindset

This journey was never just about debt. It was about transformation. By learning how to use tax strategy as a tool for financial progress, I gained more than extra cash—I gained confidence. I stopped seeing myself as a victim of circumstances and started seeing myself as a capable manager of my own money. Every small win—a credit claimed, a deduction timed, a payment accelerated—reinforced that belief. Over time, my relationship with money changed. I became more intentional, more proactive, and less reactive. I started asking better questions, seeking reliable information, and making decisions based on data, not fear.

Today, I’m not just out of debt—I’m building wealth. The habits I formed during my payoff years have carried over into saving, investing, and long-term planning. I contribute regularly to retirement accounts, maintain an emergency fund, and continue to optimize my taxes each year. But the most important change is internal. I no longer wait for permission or a windfall to improve my finances. I know that progress comes from consistent, informed action. If you’re struggling with debt, feeling stuck, or overwhelmed by bills, I want you to know there’s hope. You don’t need a raise or a miracle. You need clarity, a plan, and the willingness to use every legal tool available. Sometimes, the fastest way out of debt isn’t earning more—it’s keeping more of what you already earn. And that starts with understanding your taxes not as a burden, but as a bridge to freedom.